[vc_row][vc_column][vc_column_text]MSME Entrepreneurs in Peenya should choose their Vendors judiciously so as to take benefit of the input tax credit being offered by the new system:

PIA President R. Krishnamurthy

The Ministry of Micro, Small and Medium Enterprise (MSME) has shown their readiness and preparedness to guide and help the sector related to issues and concerns of the newly introduced indirect tax regime – Goods and Services Tax (GST), according to MSME Ministry’s top bosses.

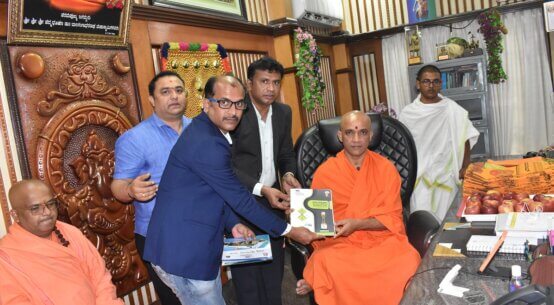

At a national workshop on GST and Digital MSME organized by the MSME Ministry and FICCI, Sri Kalraj Mishra, Hon’ble Union Minister for MSME said that by rolling out GST, cascading of taxes will be overcome and this will significantly reduce the tax burden. Furthermore, this will pave the way for a formal economy hence will give a fillip to growth and employment generation. Therefore, MSMEs should see this as an opportunity rather than a challenge. Responding to the Minister’s observations, Sri R. Krishnamurthy, President, PIA acknowledged that the Centre has taken up various efforts to popularize GST. He informed all the Member-units and the MSMEs that GST Cells have been set up in all MSMEDIs and Tool Rooms, in addition to a Facilitation Cell with a toll free number – 1800-111-955 by the NSIC. He also advised the Members to refer to a special issue of Laghu Udyog Samachar published by the MSME Ministry focusing on GST for fuller details.

At a national workshop on GST and Digital MSME organized by the MSME Ministry and FICCI, Sri Kalraj Mishra, Hon’ble Union Minister for MSME said that by rolling out GST, cascading of taxes will be overcome and this will significantly reduce the tax burden. Furthermore, this will pave the way for a formal economy hence will give a fillip to growth and employment generation. Therefore, MSMEs should see this as an opportunity rather than a challenge. Responding to the Minister’s observations, Sri R. Krishnamurthy, President, PIA acknowledged that the Centre has taken up various efforts to popularize GST. He informed all the Member-units and the MSMEs that GST Cells have been set up in all MSMEDIs and Tool Rooms, in addition to a Facilitation Cell with a toll free number – 1800-111-955 by the NSIC. He also advised the Members to refer to a special issue of Laghu Udyog Samachar published by the MSME Ministry focusing on GST for fuller details.

Striking a cautionary note, Sri Krishnamurthy also appealed to the Members and MSME entrepreneurs to choose their vendors judiciously so as to take benefit of the input tax credit being offered by the new system.

A note from the MSME Ministry said that E-initiatives have been taken in simplification of guidelines wherein PMEGP has been made online. Online Grievance Redressal and Monitoring Systems (CPGRAMS and IGMS) have been established. E-office and Mobile friendly website have been initiated and ‘My-MSME’ Mobile App, MSME-Data Bank Portal and Digital-MSME portal have been started.

The Digital MSME Scheme has been launched to sensitize and encourage MSMEs towards new approach i.e., Cloud computing for ICT adoption in their production and business processes with a view to improve their competitiveness in National and International Market.

According to Hon’ble Minister of State for MSME Sri Giriraj Singh, by rolling out GST, the Government has opened new opportunities for the hitherto unorganized rural entrepreneurs predominantly in the micro and small segment. The huge parallel economy which has been existing till now will subsequently come in the formal fold, with the emergence of GST, he said.[/vc_column_text][/vc_column][/vc_row]